Credit Repair Services

Axcess Funding is here to help you meet your credit score goals. Our credit repair services can help you work to remove the inaccurate or unfair negative items listed on your credit report.

Credit Repair Services

If you’re one of the 68 million score-able Canadian with a bad or poor credit

score—lower than 601—you’ve probably wondered if removing negative items

can help your standing.

How does Axcess Repair work ?

Repair Your Credit History

Credit repair companies work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score. They ensure your credit history is up-to-date, accurate, and honestly reflects your finances.

Monitor Your Credit Profile

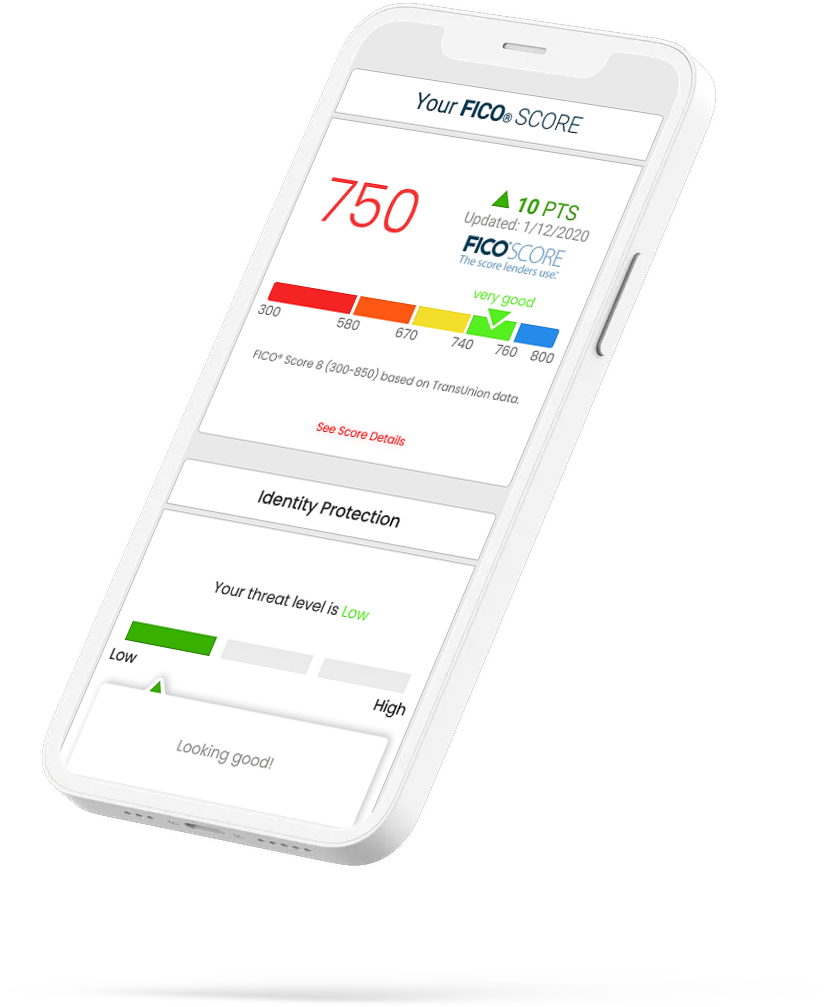

24×7 Credit Monitoring and Alerts powered by TransUnion or another provider lets you stay aware of the changes and updates on your report. And it provides customized information and advice about how those reported items affect your score.

Build Your Financial Future

Customized tools, educational approaches and proven technologies offered by credit repair companies guide you through the tasks and action items you need to take in order to maintain a healthy score and accomplish your credit goals.

Repair Your Credit History

Credit repair companies work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score. They ensure your credit history is up-to-date, accurate, and honestly reflects your finances.

Monitor Your Credit Profile

24×7 Credit Monitoring and Alerts powered by TransUnion or another provider lets you stay aware of the changes and updates on your report. And it provides customized information and advice about how those reported items affect your score.

Build Your Financial Future

Customized tools, educational approaches and proven technologies offered by credit repair companies guide you through the tasks and action items you need to take in order to maintain a healthy score and accomplish your credit goals.

Understanding the credit repair process

Research & Review

First, we take a close look at your credit and determine which questionable negative items are wrongfully hurting your score.

Challenge & Dispute

Next, we ask the bureaus and your creditors to verify these negative items as accurate and fair. If they can’t, they are required to remove them.

Manage & Monitor

As you work to manage your credit wisely, we continue to leverage the law for your credit, addressing new credit issues as they appear.

Research & Review

First, we take a close look at your credit and determine which questionable negative items are wrongfully hurting your score.

Challenge & Dispute

Next, we ask the bureaus and your creditors to verify these negative items as accurate and fair. If they can’t, they are required to remove them.

Manage & Monitor

As you work to manage your credit wisely, we continue to leverage the law for your credit, addressing new credit issues as they appear.

Credit Repair Service Levels

Concord Standard

Basic

Concord Premier

Moderate

Premier Plus

Advanced

Concord Standard

Basic

Concord Premier

Moderate

Premier Plus

Advanced

—

How long does credit repair take?

Unfortunately, there’s no way to predict in advance how long it will take to repair your credit, as every credit report is unique. That being said, we help hundreds of thousands of people each year work to repair their credit, and typically they’ve stayed with us for six months. With our team of professionals, credit monitoring software and mobile app dashboard, our removal process is streamlined to get you results.

6 months

—Frequently asked

questions.

Can’t find the answer you are looking for, shoot us an email or call in, our team is working around the clock.

Are you a real company?

Yes, we are federally incorporated and registered with the Canadian Lenders Association. We have been in operation since 2018.

What affects my credit score?

There are five main contributors to your credit score—payment history, credit usage, credit age, credit mix and recent credit. The most important of these factors is your payment history, which can be directly influenced by credit repair.

Can my credit be repaired?

While we can’t guarantee your credit will be repaired, we can promise to help you work to address any unfair or inaccurate negative items hurting your credit profile.

Is credit repair legal?

Yes—you have a legitimate and legal right to a fair, accurate and substantiated credit report. Credit repair is simply the process of challenging and disputing questionable negative items on your report to ensure those three standards are met—fairness, accuracy and substantiation. While there are many laws that apply to your credit, the Credit Repair Organizations Act (CROA) and Fair Credit Reporting Act (FCRA) are the two laws we leverage the most.

Is it worth paying for credit repair?

Think of credit repair like an investment. A little effort today could lead to thousands of dollars in savings tomorrow. We offer a variety of service levels to support every budget. Give us a call today and we’ll help you find the right service for your unique circumstance.

What is a negative item?

A negative item on your credit is anything in your credit history that could lower your score. It includes things like collections, late payments, charge-offs, liens, bankruptcies, repossessions and more. Especially if these negative items came as a result of identity theft, divorce, medical debt, student debt or military leave, you may be able to remove them through credit repair.

Are you a real company?

Yes, we are federally incorporated and registered with the Canadian Lenders Association. We have been in operation since 2018.

What affects my credit score?

There are five main contributors to your credit score—payment history, credit usage, credit age, credit mix and recent credit. The most important of these factors is your payment history, which can be directly influenced by credit repair.

Can my credit be repaired?

While we can’t guarantee your credit will be repaired, we can promise to help you work to address any unfair or inaccurate negative items hurting your credit profile.

Is credit repair legal?

Yes—you have a legitimate and legal right to a fair, accurate and substantiated credit report. Credit repair is simply the process of challenging and disputing questionable negative items on your report to ensure those three standards are met—fairness, accuracy and substantiation. While there are many laws that apply to your credit, the Credit Repair Organizations Act (CROA) and Fair Credit Reporting Act (FCRA) are the two laws we leverage the most.

Is it worth paying for credit repair?

Think of credit repair like an investment. A little effort today could lead to thousands of dollars in savings tomorrow. We offer a variety of service levels to support every budget. Give us a call today and we’ll help you find the right service for your unique circumstance.

What is a negative item?

A negative item on your credit is anything in your credit history that could lower your score. It includes things like collections, late payments, charge-offs, liens, bankruptcies, repossessions and more. Especially if these negative items came as a result of identity theft, divorce, medical debt, student debt or military leave, you may be able to remove them through credit repair.